CP14 Notice: What It Is, Why You Got It, and What To Do Next

Got a CP14 from the IRS? Breathe.

It’s common. It’s fixable. Acting early keeps costs down.

This guide breaks down what a CP14 is, why you received it, your options, and how to move forward whether you agree with the IRS or not.

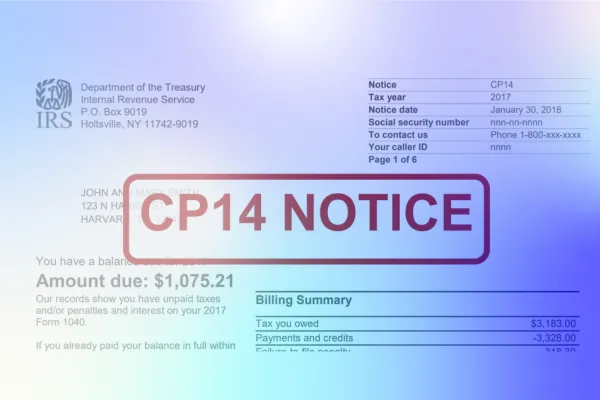

What Is a CP14 Notice

A CP14 is the IRS letter that says you owe a balance after your return was processed.

It’s usually the first bill in the collection timeline.

In short: the IRS says you owe and wants you to pay or respond within about 21 days.

Common reasons you get a CP14:

You filed but didn’t pay in full

You missed a payment

The IRS adjusted your return and a balance remains

What the CP14 Includes

You’ll typically see:

The tax year in question

Total amount due, including penalties and interest to date

A payment or response deadline

Ways to pay, correct, or set up a plan

What Happens If You Ignore It

If you do nothing, the IRS sends more notices with increasing urgency:

CP501 and CP503 follow as reminders

Then a final notice such as LT11/Letter 1058 or CP504 arrives

Real risk starts after the final notice. That’s when the IRS can begin enforcement like levies or garnishments if you still don’t respond.

Also know: once you don’t pay after assessment and demand, a statutory lien arises by law. The IRS may later file a Notice of Federal Tax Lien if the debt stays unpaid.

Ignoring a CP14 doesn’t make it disappear. It makes it more expensive.

Your Options

1) You agree and can pay

Pay in full by the deadline. Online is fastest.

You’ll stop new penalties and interest from piling on.

2) You agree but can’t pay in full

Request a payment plan.

Short-term plans can give you time to pay in full. Long-term installment agreements break it into monthly payments.

Act early to avoid enforcement and keep stress low.

3) You disagree with the notice

If the amount looks off or a recent payment isn’t showing:

Call the IRS and provide proof

Fix the underlying issue (for example, file an amended return if needed)

Keep copies of everything

CP14 is not a formal appeal notice, but you can resolve errors and request corrections now.

4) You want help decoding and choosing a path

Upload your CP14 to BackTaxAI.

Our assistant will read the notice, explain what it means, flag penalty relief options, and simulate payment plan scenarios in minutes.

When To Call a Pro

Consider extra help if you:

Owe more than you can realistically handle

Have multiple unfiled years

Are seeing liens, levies, or wage garnishment on the horizon

BackTaxAI can also check if you may qualify for first-time penalty abatement, an Offer in Compromise, or Currently Not Collectible status.

Bottom Line

A CP14 is a warning, but it’s also an opportunity.

Move now and you control the next step. Wait, and the IRS will.

Open it. Understand it. Take action.

BackTaxAI can guide you, fast.